TAX BENEFITS APPLICATION TOOL

The Client

AARP Foundation is an organization whose primary mission is to alleviate senior poverty by helping vulnerable, older adults access economic opportunities. The Foundation is the affiliated charity of AARP, and it embodies the mission of AARP while raising and donating funds to furthering their cause: creating and advancing solutions for seniors to build economic opportunity and social connectedness. For every dollar spent by AARP Foundation, eighty-one cents go towards programs and services that help low-income older adults.

The Challenge

Did you know that there are 8.5 million seniors who are eligible for property tax benefits, yet only 8% apply? This challenge is the one that AARP Foundation Property Tax-Aide program is striving to solve. When AARP Foundation came to Fifth Tribe, their specific goal was to find a way to provide these millions of eligible low income seniors a platform to easily apply for property taxes and SNAP (food stamps). The tool would need to be easily navigable, informative, and user friendly.

The Strategy

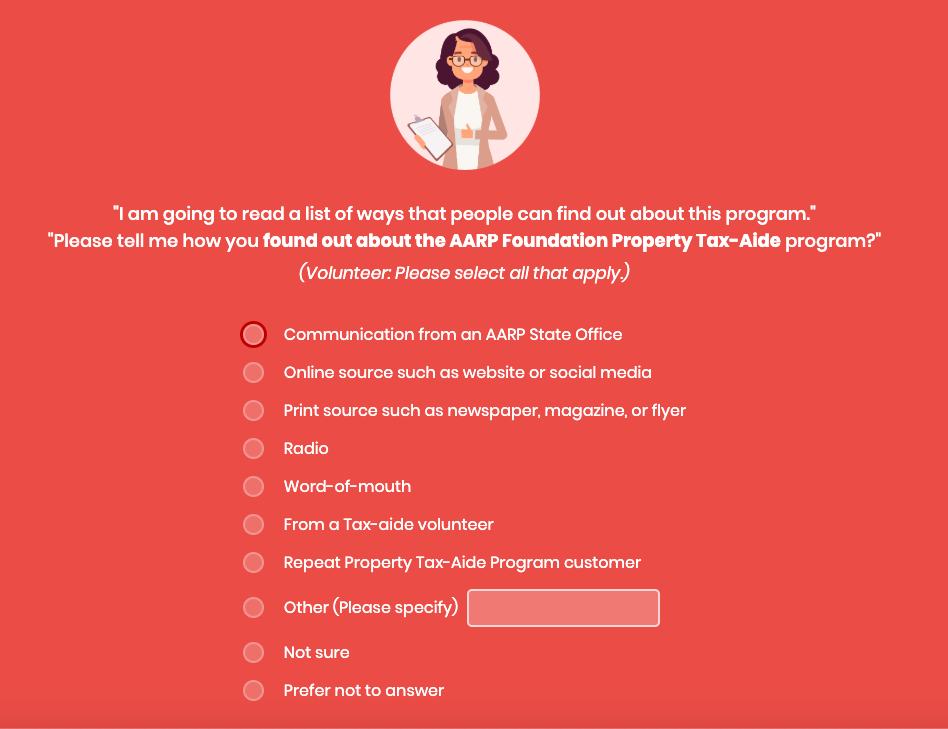

In order to bring this vision of the AARP Foundation Property Tax-Aide tool to life, Fifth Tribe would need to utilize every creative mind of our team. We first conducted a design sprint, during which we studied how the target user groups were learning and applying for property tax and SNAP benefits. Moving through ideation, we created a prototype, which validated the experience with low income senior groups in three states; throughout this process, we also continued to pivot the interface until we found a flow and format that led to high NPS scores.

The Results

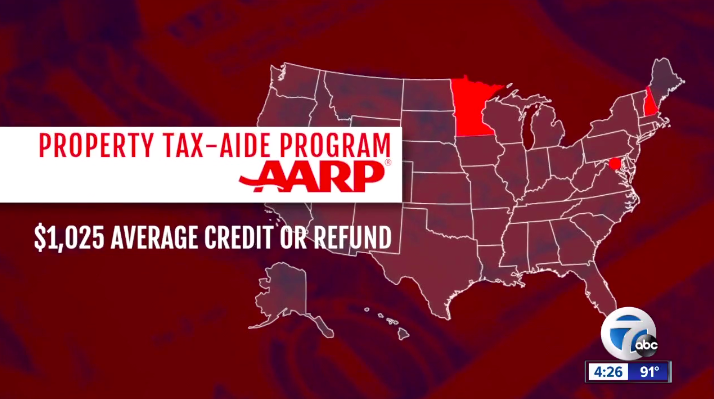

The AARP Foundation Property Tax-Aide tool rolled out in three states: Minnesota, New Hampshire, and Washington, D.C. This tool is making an impact by helping seniors receive the benefits for which they are eligible, which ultimately makes it more possible for them to remain economically independent. One user, who spoke about the tool on WXYZ-DET (ABC), remarked that, “This is the first time I’ve ever known about [property tax benefits], this is the first time I’ve ever even applied for it.” Older adults qualify for around $1,000 in property tax credits/refunds, and the AARP Foundation is striving to make those funds more accessible in order to help seniors stay in their homes longer. They plan to roll this tool out in more than two dozen other states over the next two years – and Fifth Tribe will be along for the ride!